How to Close Axis Bank Loan Account Online

Axis Bank has been informing the customers about the large loan scheme. The loan interest is set separately for each loan. The process of buying a loan in Axis Bank is very simple, the bank manager goes directly to the customer who comes to buy the loan and I register them. They used to pay monthly through EMI on the loan obtained.

Axis Bank has introduced the facility of paying the principal amount and interest through EMI while the loan amount is set to be paid for a specific year. Sometimes the customer wants to repay the loan in installments or lump sum.

For that, Axis Bank has now got offers through various websites. Axis has brought the facility of paying the entire amount in between without paying the loan received till that particular year or paying half of the principal amount between the loan period.

As the customer repays the full amount of the loan by the end of the year, they get rid of monthly EMIs. There are chances that the next loan purchase offer will be made from Axis Bank. There are chances to increase the CIBIL score.

As the customer pays half of the loan from Axis Bank in full, they have to pay up to five percent of the loan amount to the bank. It is not only the whole payment but also the payment of a certain amount is charged up to this five percent.

Not only that, GST is also charged on it. The five percent fee thus received will be the same for the entire year of the loan and the interest will be equal. As a result, the customer pays the loan between the term without any benefit. On a loan, you pay the customer half-full because they have cash on hand.

At times when the customer needs money at the same time there may be opportunities to buy the next day at higher interest rates. So it is very good for the customer to think twice before paying the loan before the end of the loan period.

Online Closure of Axis Bank Loan Account

Find an EMI and part payment mode through the Axis Bank mobile application.

Step : 1

Click the link given below and install Axis Bank Mobile Application. https://play.google.com/store/apps/details?id=com.axis.mobile

Step : 2

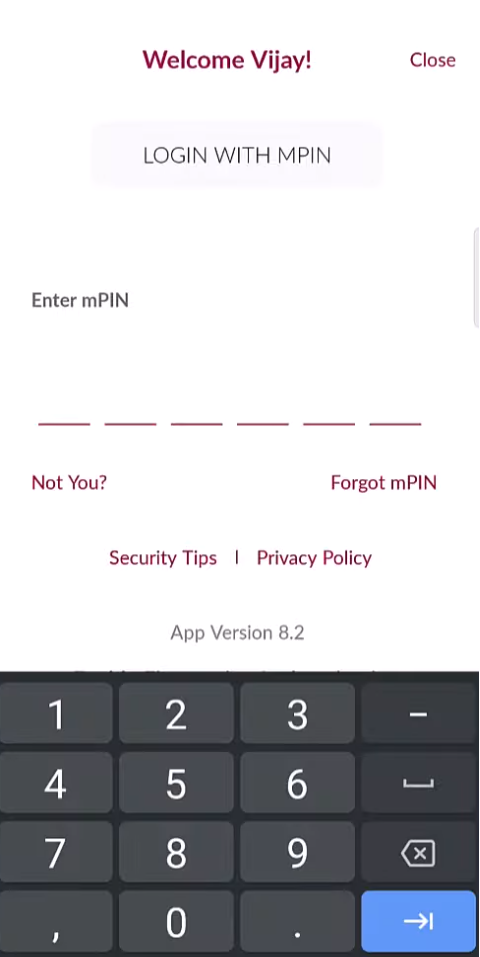

You need to login to the Axis Bank application.

Step : 3

A password is set for accessing the Axis Bank mobile application for the security of a customer. Vijay is now logging it.

Step : 4

He will also give you an option to view your last transaction below the amount in your Home Image customer’s account. Take it down and see.

Step : 5

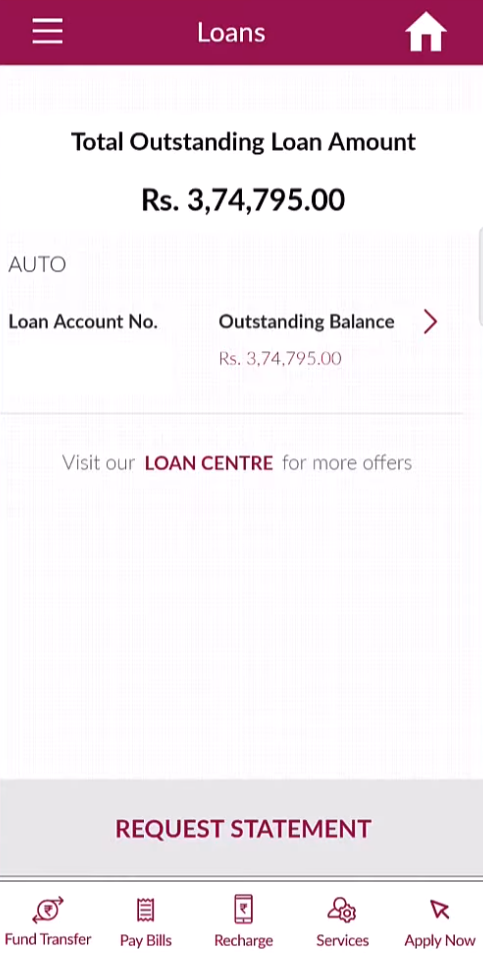

In this you have to click on loan option.

Step : 6

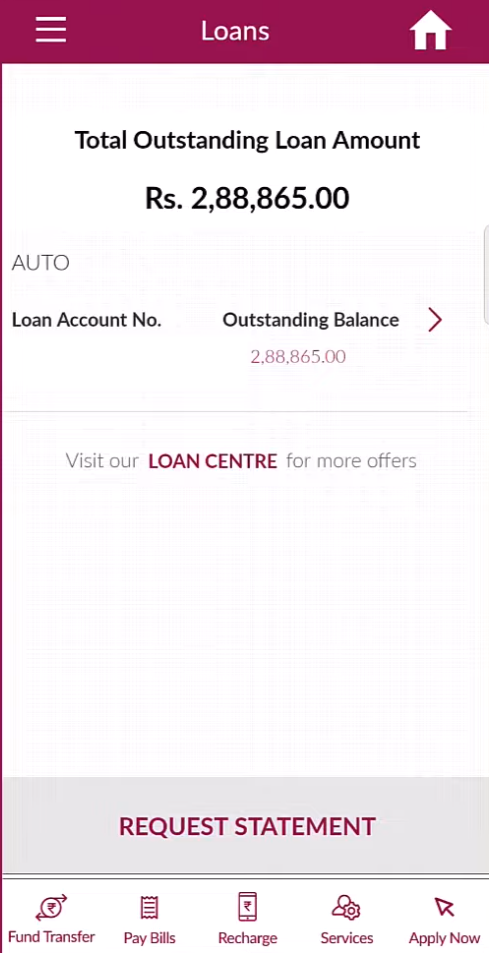

In the next image, the total amount of the loan taken by Vijay will be shown. Click on that loan amount.

Step : 7

In the next image, Vijay’s total loan amount will be reported for the entire year and the month before the payment. All the information about how much EMI is being paid will come. We can know complete information about loan on this page. Then click on Make Payment option below.

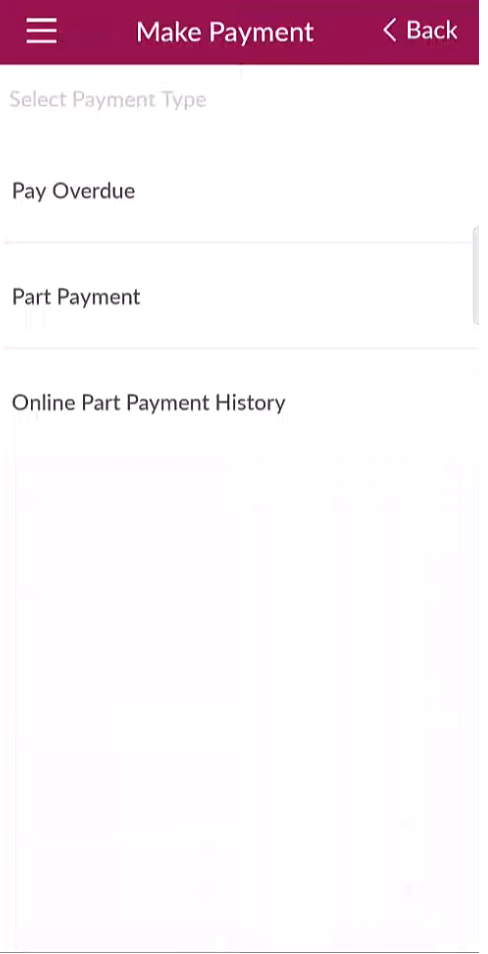

Step : 8

On next page overdue for payment online part payment history will be given. Click on Part Payment option.

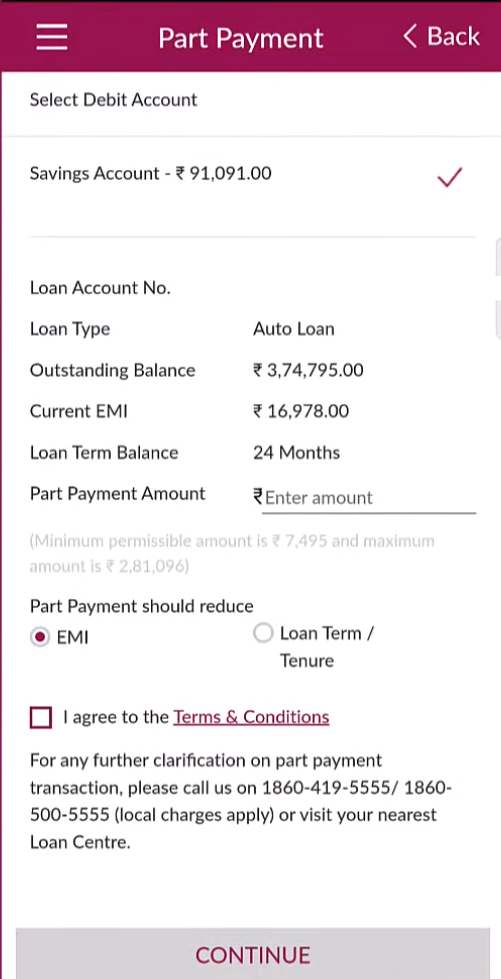

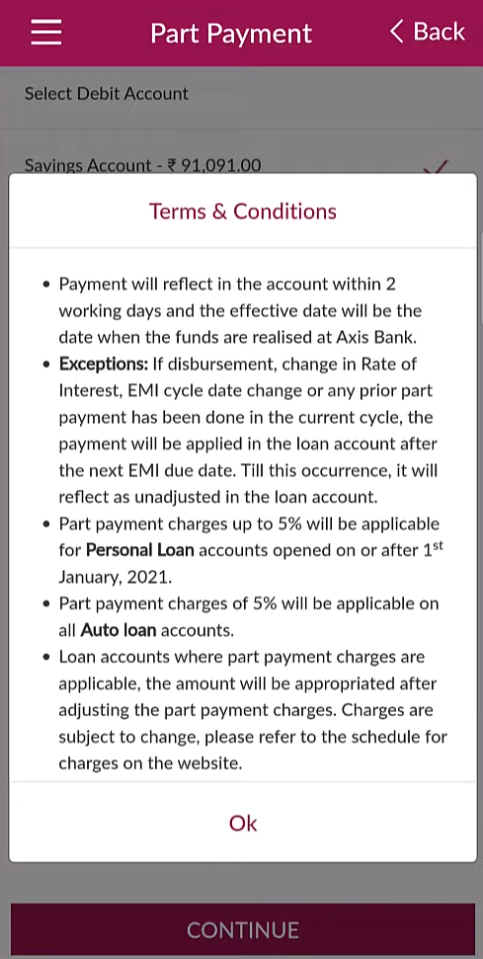

Step : 9

The next page shows the money in Vijay’s savings account. After that, the amount of the loan that he has purchased, the remaining amount and the monthly EMI amount will be reported. Below that you will be asked how much part payment you are going to pay. Below that fill this page which is given as EMIR Loan Download.

Step : 10

As Vijay wants to pay 91 thousand rupees in his account, he types it and clicks Langtern option in Reduce option in Part Diamond Cedi below and I accept to the terms and condition box below and clicks Continue button

Step : 11

On the next page, the information about when the principal amount paid by Vijay will be deducted from the loan amount and how much interest will be paid due to the partial payment of the loan. It should be checked completely and continue.

Step : 12

Next image you make payment and the confirmation will come as success.

Step : 13

Two days later, when Vijay logs into the axis bank application, it says that the amount paid by him from the loan has been deducted. In this way, you can pay the loan in full or part payment through axis bank mobile app in a very simple way.